Effective Debt Consolidation Strategies

Introduction

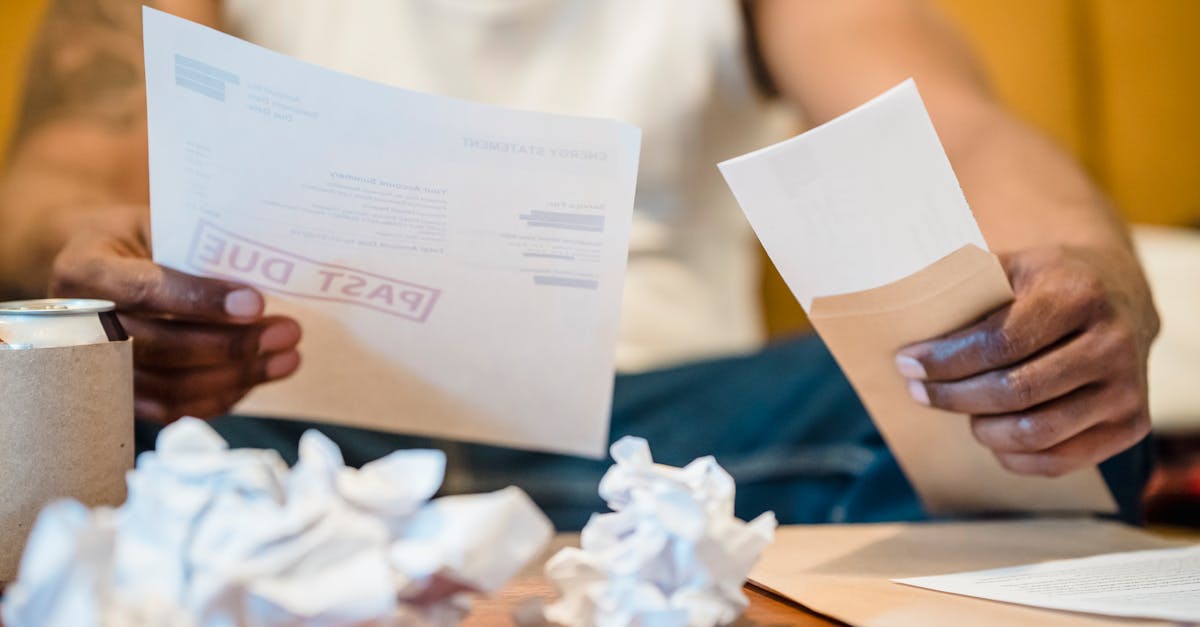

Managing multiple debts can be daunting, leading to financial strain and stress. Debt consolidation offers a viable solution to simplify repayments and regain control over personal finances. This article explores effective strategies for consolidating multiple debts to improve financial health.

Advertisement

Understand Your Debt Situation

The first step in debt consolidation is understanding your current debt situation. Make a comprehensive list of all debts, noting the outstanding balance, interest rates, and due dates. By having a clear picture, you can prioritize which debts to consolidate and plan your strategy effectively.

Advertisement

Evaluate Different Consolidation Options

There are several methods for consolidating debts, including personal loans, balance transfer credit cards, and home equity loans. Each comes with its advantages and drawbacks, so it's crucial to evaluate which option aligns best with your financial situation. Research and compare interest rates, fees, and terms before making a decision.

Advertisement

Consider a Debt Consolidation Loan

A popular method is taking out a debt consolidation loan to pay off multiple smaller debts. This results in a single monthly payment, often with a lower interest rate. Consolidation loans can be obtained through banks, credit unions, or online lenders. Verify the lender's credibility and read the terms carefully before proceeding.

Advertisement

Use a Balance Transfer Credit Card

Another option is transferring high-interest credit card debt to a card with a low or zero introductory interest rate. This can significantly reduce the cost of debt repayment. Be wary of balance transfer fees and ensure the new card is paid off before the promotional period ends to avoid exorbitant interest rates.

Advertisement

Leverage Home Equity

For homeowners, borrowing against home equity can be a cost-effective consolidation strategy. Home equity loans often have lower interest rates, but the risk is that your home serves as collateral. It's essential to have a clear repayment plan to avoid jeopardizing your home.

Advertisement

Seek Professional Guidance

If self-managed consolidation seems overwhelming, consult a credit counseling service or financial advisor. They can assist in crafting a realistic budget, negotiating with creditors, and setting achievable financial goals. Choose reputable organizations that offer free or low-cost services.

Advertisement

Implement a Strong Repayment Plan

Consolidating debts is only part of the solution; you need a strong repayment plan to succeed. Create a budget that accommodates your consolidated debt payments without accumulating new debt. Prioritize expenses and track spending to stay on course.

Advertisement

Avoid Future Debt Accumulation

To ensure consolidation efforts are effective long-term, commit to avoiding future debt accumulation. Establish an emergency fund, minimize reliance on credit, and practice disciplined spending. Educating yourself about personal finance and building a savings buffer can prevent future debt crises.

Advertisement

Summary and Conclusion

Consolidating multiple debts can simplify your financial life and reduce stress. By evaluating options, leveraging expert advice, and sticking to a repayment plan, it's possible to achieve financial stability. Take proactive steps to manage debts responsibly and pave the way to a secure financial future.

Advertisement